Long-term Care

Long-term Care

In 2006, the first wave of baby boomers turned 60 and many have decided to retire. According to a MetLife demographic study done in 2003, baby boomers make up 27.5% of the U.S. population, which translates to over 77 million people. With so many people approaching their golden years, the costs of long-term care are expected to skyrocket. But how many of these retirees would be prepared to pay a $250,000 long-term care bill? For many, covering these costs would require a substantial financial outlay. So, it’s a good idea to consider some alternatives that exist to manage this risk.

Under the traditional long-term care (LTC) insurance policies, you pay an annual premium for an insurance policy that will pay for your nursing care should something happen to you down the road. But these premiums can range from $2,500 to $5,000 per year (and the costs are rising), and many people find it tough to shell out for a LTC insurance policy that they may never use. On the other hand, care costs are rising too – they can be more than $70,000 per year – so you need to take a hard look at your finances to see if they could sustain such a devastating blow. After all, you insure your car and your home, so why not your well-being?

The chart below summarizes the types of Long-Term Care options and the different provisions for funding each method of care:

| Medicare | Medicaid | Pay-As-You-Go | LTC Insurance | |

| Nursing Home | Yes – for up to 100 days of medically necessary, skilled care. | Yes – for as long as custodial care is needed. | Yes – as long as your money lasts. | Yes – according to the chosen policy’s benefit, period and amount. |

| At-Home Care | Maybe, but not likely. | Maybe – depends on your state. | Yes – as long as your money lasts. | Yes – according to the chosen policy’s benefit, period and amount. |

| Assisted Living/ Continuing Care | No | Rarely- it depends on your state. | Yes – as long as your money lasts. | Yes – according to the chosen policy’s benefit, period and amount. |

| Alzheimer’s/Group- Home Care | Rarely | Maybe – it depends on your state. | Yes – as long as your money lasts. | Yes – according to the chosen policy’s benefit, period and amount. |

| Respite Care | No | Rarely – it depends on your state. | Yes – as long as your money lasts. | Yes – according to the chosen policy’s benefit, period and amount. |

| Adult Day Care | No | Rarely – it depends on your state. | Yes – as long as your money lasts. | Yes – according to the chosen policy’s benefit, period and amount. |

| Home Modification | No | Rarely – it depends on your state. | Yes – as long as your money lasts. | Yes – according to the chosen policy’s benefit, period and amount. |

Notes

1. For Medicare and Medicaid, the conditions outlined in the chart apply provided the previously mentioned conditions are met.

2. Normally, for LTC insurance policies each type of LTC setting is a separate option that can stand alone, so many people pick and chose their options. Your chosen policy may not cover all these care situations.

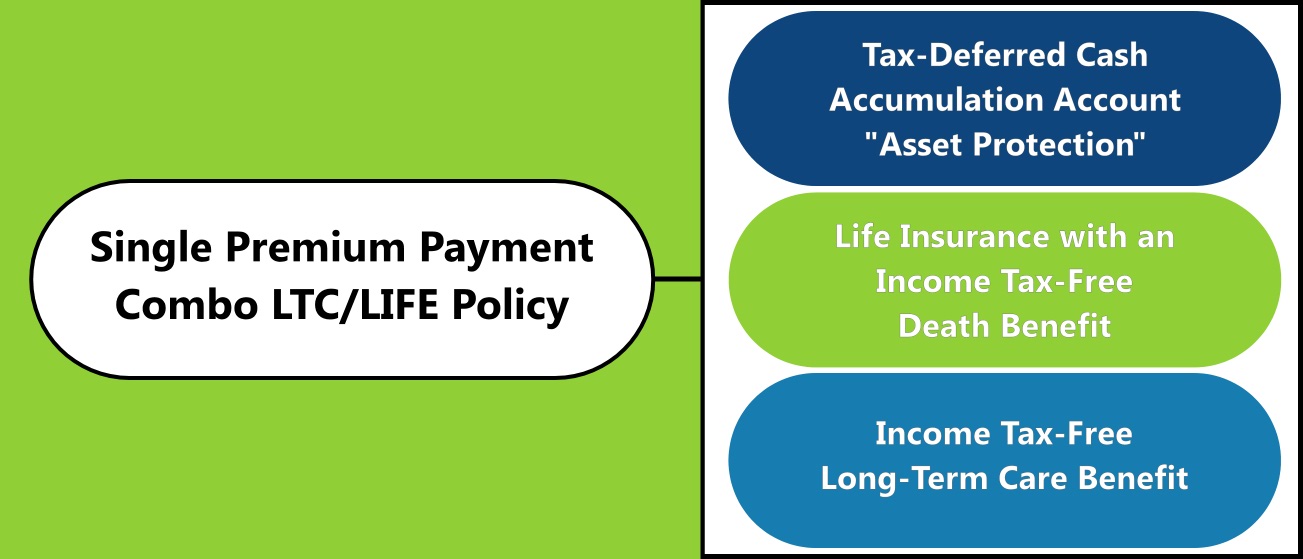

Once the premium is inside the universal life insurance policy, the account value earns an interest rate (typically at least 4%) on a tax-deferred basis, building up a cash reserve that can be used tax free to cover nursing or home-care costs. Any money that is not spent on nursing care benefits will be distributed to your heirs as an income tax-free death benefit under Internal Revenue Code Section 101(a)(1).

Example

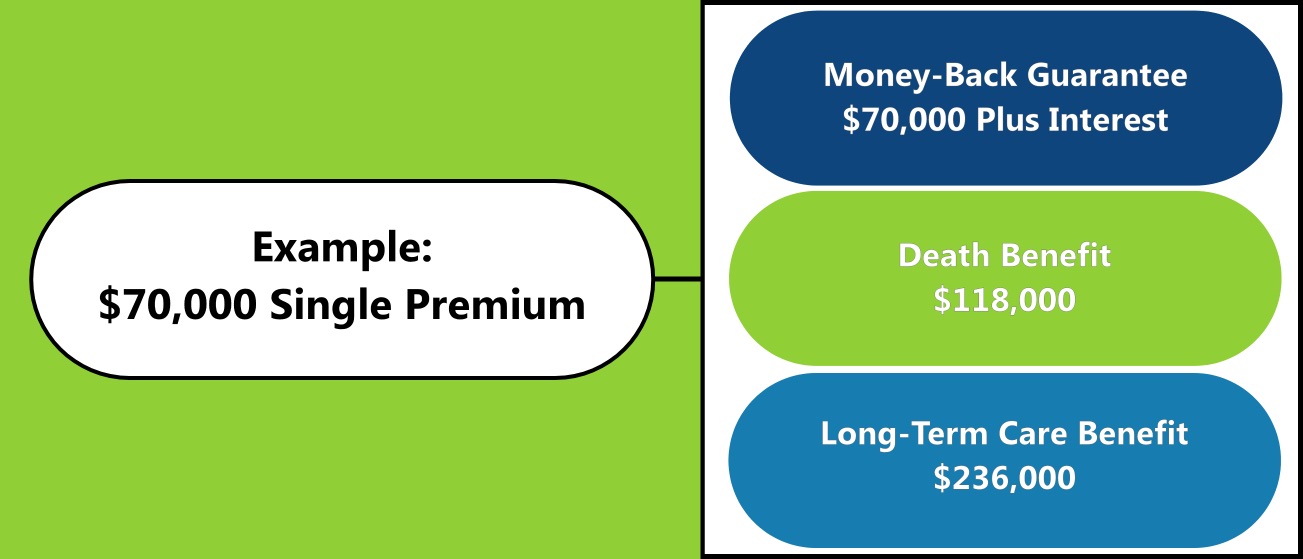

Let’s look at a sample illustration of Lincoln National Life’s MoneyGuard universal life plan. The investor is a 65-year-old retired male, non-smoker, with $70,000 in assets that could be used to pay for long-term care. The man decides to add the MoneyGuard product to his retirement portfolio and invests the $70,000 as the single premium for the plan. This will provide him with approx. $118,000 (based on issue date) in income tax-free death benefits payable to his beneficiary upon his death. He will also receive approx $236,000 (based on issue date) income tax-free benefit for long-term care (figures for universal life product are based on state of Florida current rates as of December 2005). If the investor decides that MoneyGuard just isn’t for him, and he doesn’t make any withdrawals, loans or changes to the benefits, the insurance company will guarantee the return of his initial premium. In many cases, a residual death benefit is paid to the beneficiaries even if all long-term care benefits are used by the insured.

Funding the Plan

This type of LTC/life plan typically requires a one-time lump sum deposit amount rather than the traditional monthly or systematic premium payments. Therefore, you’re entering into an asset transfer process that will require you to uncover “lazy assets” to invest in the policy. Common assets considered for investment include bank certificates of deposit (CDs), savings accounts and other fixed-income investments. You might also find a variety of previously issued permanent life insurance policies with cash values that you can combine and use as the initial transfer into the LTC/life contract.

Conclusion

By including an LTC/life plan in your retirement portfolio, you gain the opportunity to leverage a lump sum of your retirement savings for multiple benefits, including both generational wealth transfer and long-term care protection on a tax-favored basis. If you decide not to obtain an LTC policy and choose to “self-insure” instead, you’ll need to set aside a significant amount of money to cover all the risk. This new type of LTC/life policy helps you to avoid the frustration of paying premiums for a long-term care policy that might never be used. It can also work as an effective estate planning tool that allows you to remove the premium from your taxable estate or to have the policy owned by your adult children, thus also allowing the death benefit to be removed from your estate.

Bradenton Long-term Care | Ellenton LTC | Dave Cook Sarasota FL