November 1st – December 15th

(ACA Open Enrollment Period (OEP))

October 15th – December 7th

(Medicare Annual Election Period (AEP))

January 1st – March 31st

(Medicare Open Enrollment Period (OEP))

Healthcare has changed over the years and with that, so has your opportunity to enroll and disenroll in your current healthcare plan. Healthcare these days are typically broken down into two categories e.g.; Under 65 years of age and 65 and over (Medicare).

Under 65 Healthcare Plans are all governed under the new Affordable Care Act (ACA or Obamacare) except for

the old grand father and grand mother plans.

Beginning in 2014, the Affordable Care Act required non-grand fathered health plans to cover Essential Health Benefits (EHB). These essential health benefits had to be equal in scope to a typical employer health plan.

As you may have found in life, when something is given, something is also taken away. That is no exception with the new ACA law and your freedom to switch healthcare plans at your own discretion.

The Open Enrollment Period currently starts on NOVEMBER 1ST and currently runs until DECEMBER 15TH.

That means whether you bought a healthcare plan On-Exchange (through the Marketplace) or Off-Exchange (direct through an insurance carrier), this is the only time you can switch healthcare plans throughout the year unless you have a Special Election Period (SEP).

Many people don’t understand that there are other health plans as well that may suit your needs if you aren’t worried about pre-existing conditions. Short-term Medical (STM) plans can be much cheaper as most do not cover preventative services or pre-existing conditions. Usually about half the cost of a qualified health plan, these policies can be purchased all year long. Whether you are looking at dropping your current coverage to save money or you just need temporary coverage, Short-term Medical (364 days) may be a good alternative.

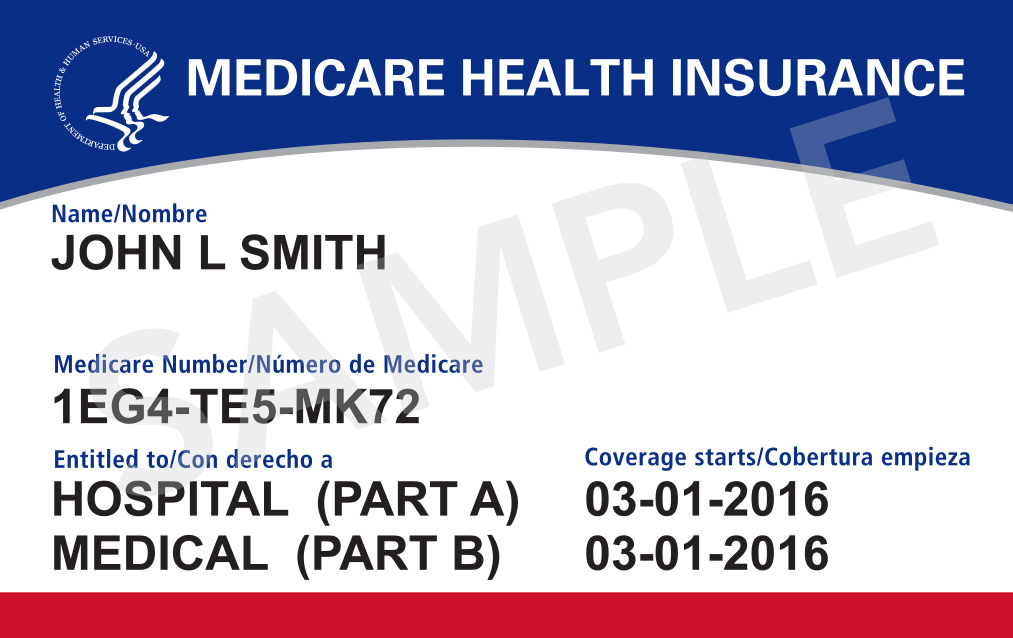

65 and Over 65 Medicare Plans are highly regulated healthcare plans designed for retirees and seniors.

On July 30, 1965, President Lyndon B. Johnson signed into law the bill that led to the Medicare and Medicaid. The original Medicare program included Part A (Hospital Insurance) and Part B (Medical Insurance). Today these 2 parts are called “Original Medicare.”

After you acquire Original Medicare, you have a choice to make. Like mentioned above, Original Medicare Part A covers your hospital stays and Part B covers your medical costs, but these two parts only cover 80% of all your expenses. That being the case, if you had a $100,000.00 procedure, you would be responsible for $20,000.00.

Since there is no limit or maximum on this 20% amount, most people either purchase a Medigap Supplement plan along with a Prescription Drug Plan (PDP) Part D or a Medicare Advantage plan which is also called Part C.

Whether you have original medicare with a Medigap Supplement and a PDP plan or you have a Medicare Advantage plan that includes a PDP plan, your Annual Election Period (AEP) is a very important time of the year.

OCTOBER 15TH – DECEMBER 7TH of every year is your AEP when you can enroll in a new Medicare Advantage or Prescription Drug Plan (PDP) that will become effective January 1st of the coming year.

Note: Supplements or Medigap plans still require underwriting and you can switch those plans throughout the year as long as you can pass the underwriting questions on the application.

If you choose a Medicare Advantage plan and want to return to Original Medicare and enroll in a PDP plan, you can do so during the Open Enrollment Period (OEP) that runs from JANUARY 1ST – MARCH 31ST of every year.

So whether you have an Under 65 or a Medicare healthcare plan, these dates should not be taken lightly.

During the course of the year things may have changed regarding your healthcare needs e.g.; your doctor no longer accepts your plan, your prescriptions have changed, you are expecting a baby and the list goes on.

Other things to consider for the upcoming year may be, better coverage with lower monthly premiums, loss of tax credit or subsidy, drugs no longer in formulary and etc.

Either way, it is important that you review your healthcare needs for the upcoming year because if you don’t, you could be stuck with that plan for the entire year.

We are here to help you during these time periods and also everyone you refer to us!

Medicare Annual Election Period | Medicare Advantage | Ellenton FL | Bradenton FL

MAIN LINKS

CONTACT US

Company Information:

Safeguard Assurance LLC

11228 28th St. Cir. E.

Parrish, FL 34219

(941) 932-1388 or 1389

info@safeguardassurance.com